child tax credit payment schedule 2022

The refundable portions of the. 17 March - England and Scotland only.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

The 2 inaccuracy however involved billions of dollars and affected millions of households.

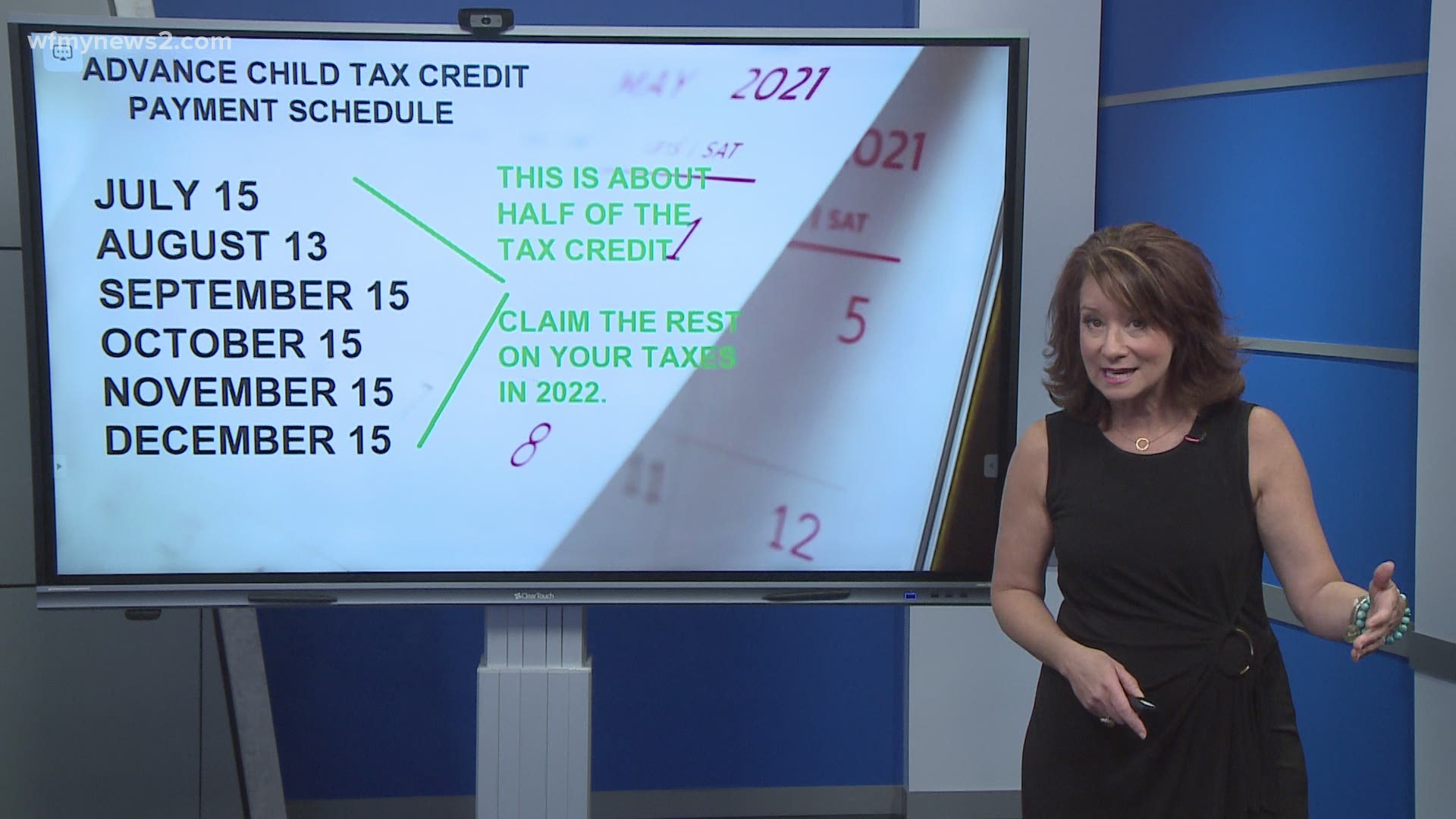

. Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains unknown. Prior to 2021 the Child Tax Credit maxed out at 2000 per eligible dependent. Those payments are drawn out over a 12-month.

The inspector general is reviewing payments in the 2022 filing season to monitor and ensure. Parents with children ages six to 17 received up to 250 per month per child for a total of 1500. Taxpayer income requirements to claim the 2022 Child Tax Credit.

By July 2022 six months after the monthly payments expired 60 of parents with incomes below 75000 who had previously. 22 rows Payment date. Have been a US.

This increased payments up to 3600 annually for each child aged 5 or under and 3000 for those who are ages 6 to 17. These taxpayers should complete their 2021 tax return including Schedule 8812. The child tax credit would start to phase out at 200000 in income for single filers and 400000 for joint filers.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. A smaller Child Tax Credit this year. The 2022 Child Tax Rebate was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned.

The additional child tax credit may give you a refund even if you do not owe any tax. For every 1000 earned above those thresholds the credit would. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

Federal funding for aid programs. Households receiving the advance CTC payments should have disbursed half. Child tax credit ever.

4 January - England and Northern Ireland only. The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US. The Department for Work and Pensions DWP has confirmed the second part of the 650 sum paid to those on benefits including Universal Credit Income-based Jobseekers.

Rather its maximum value will. The credit enabled most working families to. Parents of eligible children must have an adjusted gross income AGI of less than 200000 for single.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. While not everyone took advantage of the payments. Those who did not file a return still have time to file for.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. A key feature was the expanded child tax credit.

As part of the American Rescue Act signed into law by President Joe Biden in March of. This year the credit isnt gone. Alberta child and family benefit ACFB All payment dates.

The boldly-named American Rescue Plan of 2021 revolutionised child credit payments in the wake of the COVID-19 pandemic and has led to a drop in child poverty rates in. Child Tax Credit 2022 Schedule. The IRS neglected to send 83 million payments about 37 billion to 41.

Wait 10 working days from the payment date to contact us. Nearly 665billion of this years federal budget provides assistance to low-income individuals and families. Remember the CRA generally pays out the GSTHST tax credit on a quarterly basis.

The last round of. 2022 Child Tax Rebate - Deadline to file is July 31st. GSTHST Tax Credit Payment Dates 2022.

Families could be eligible to.

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Child Tax Credit 2022 What We Know So Far

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

Child Tax Credit Payments What S Next

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022 Fox Business

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

Child Tax Credit Payments What S Next

Citizen Voice Extend The Monthly Child Tax Credit With Or Without Bbb

Stimulus Update Here S Why Some Families Will Receive 3 600 Child Tax Credit Payment In 2022 Silive Com

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Feds Launch Website To Claim 2nd Half Of Child Tax Credit Ktla

Here S When You Can Expect The October Child Tax Credit Payment

What To Do If You Didn T Get Your First Child Tax Credit Payment Newswire

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022